I just came across this on the BBC web pages. My left eyebrow became elevated by a millimeter.

An IVA is like a payday loan, but for more money and over a longer period of time.

I realize I may be 'lip implant-shaming' but it would be better to do it here than on a thread ostensibly about Botox. Which is a very different thing.

I suppose this made me also think about priorities, responsibility and judgement.

I think my left eyebrow has just gone up another millimeter.

For more context:

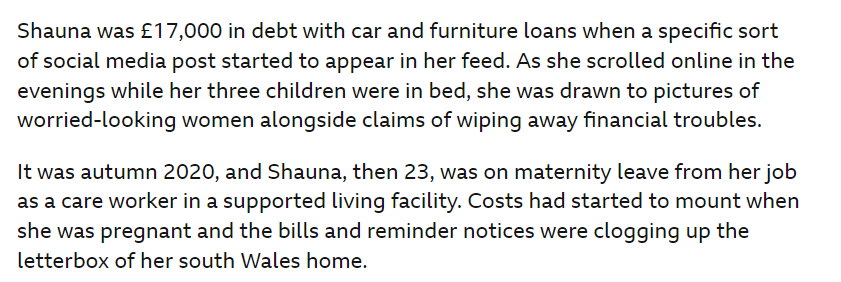

'I feel manipulated’: The 'debt help' ads targeting struggling mums

Social media posts are targeting people in problem debt with a product that could leave them worse off.

www.bbc.co.uk

An IVA is like a payday loan, but for more money and over a longer period of time.

I realize I may be 'lip implant-shaming' but it would be better to do it here than on a thread ostensibly about Botox. Which is a very different thing.

I suppose this made me also think about priorities, responsibility and judgement.

I think my left eyebrow has just gone up another millimeter.

For more context: