You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

[Finance] Should Pensioners Pay Tax?

- Thread starter Official Old Man

- Start date

More options

Who Replied?Yes, I forgot about that! Another rather illogical benefit that will no doubt be looked at.OAP’s don’t pay national insurance at all, even on employment earnings.

I was thinking about my situation, where having retired early, my personal pension is not subject to NIC.

I think it’ll remain. There are millions of OAP’s working part or full time. Equating to millions of votes.Yes, I forgot about that! Another rather illogical benefit that will no doubt be looked at.

I was thinking about my situation, where having retired early, my personal pension is not subject to NIC.

Thunder Bolt

Silly old bat

Answering my own question. We have two tier pensioners. I won't be getting £203.85 even though I had twelve or more years paying into SERPS, before being allowed to join a pension scheme. Part-timers weren't allowed to in those days.Isn't the £10,600 state pension for newer pensioners, ie those born after 1950?

The full rates for 2023/24 will be: £203.85 per week for the new State Pension (for those reaching State Pension age on or after 6 April 2016) – up from £185.15 in 2022/23. £156.20 per week for the basic State Pension (the core amount in the old State Pension system) – up from £141.85 in 2022/23

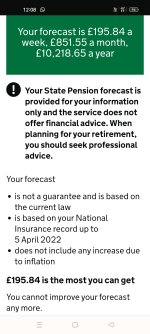

“This year”, I think you mean for 2023/24.This is my pension forecast and like you I was contracted out for a while.

Does this forecast include the Triple Lock rise for this year can anyone tell me please.

Good question, looking around online, no one’s clear. But, if you look at your screenshot forecast, it says it does not include any increase due to inflation. Based on that, if you produced that forecast in say mid April, it should be 10% greater (the triple lock effect).

Too late for you to do this?Answering my own question. We have two tier pensioners. I won't be getting £203.85 even though I had twelve or more years paying into SERPS, before being allowed to join a pension scheme. Part-timers weren't allowed to in those days.

The full rates for 2023/24 will be: £203.85 per week for the new State Pension (for those reaching State Pension age on or after 6 April 2016) – up from £185.15 in 2022/23. £156.20 per week for the basic State Pension (the core amount in the old State Pension system) – up from £141.85 in 2022/23

https://www.gov.uk/voluntary-national-insurance-contributions/deadlines

Or at least should the pension be tax free?

I'm now drawing what I've paid into for the past 50 years, my state pension. But my accountant has just given me my tax return for 2022 and I've had to pay tax on my pension. Where as most tax codes are 1263 or very close, mine is the equivelant of being 563 meaning I can only earn under £6K a year on top of my pension without paying tax.

I'm paying tax on something I've worked hard for and paid tax on already.

I might go and sit on a bus all day just to get my money back!

This is my pension forecast and like you I was contracted out for a while.

Does this forecast include the Triple Lock rise for this year can anyone tell me please.

Oddly, having paid NIC in full all my life mine is saying I get the maximum, which is £185.15 per week, yours is a tenner more?

kjgood

Well-known member

How? I have recently started to receive my state pension with full entitlement and its nothing like that? Me thinks you have made a mistake.Just started receiving my state pension and it’s £13.7k rising to £15k shortly.

- Aug 7, 2003

- 7,827

No mistake, just years of paying SERPS.How? I have recently started to receive my state pension with full entitlement and its nothing like that? Me thinks you have made a mistake.

- Jul 10, 2003

- 26,036

It's worth pointing out there are a whole set of criteria to make you eligible for additional state SERPS pension including, IIRC being born before the 1951 and having taken your state pension before 2016 (and I think, a whole set of other criteria)No mistake, just years of paying SERPS.

Deleted member 37369

Well-known member

- Aug 21, 2018

- 1,994

Same here!! I’m 74p a week short of full amount! I’m not working and have no plans to work a year just to get my hands on the additional 74p/wk!!Oddly, having paid NIC in full all my life mine is saying I get the maximum, which is £185.15 per week, yours is a tenner more?

- Aug 7, 2003

- 7,827

I wasn’t born before 1951 or took my pension before 2016 so it’s just related to contributions paid that results in an additional “Protected payment” of approx £78/week on top of the new state pension of £185/week to give £263/week or £13.7k / year. This is going to increase by 10% to £15k in April.It's worth pointing out there are a whole set of criteria to make you eligible for additional state SERPS pension including, IIRC being born before the 1951 and having taken your state pension before 2016 (and I think, a whole set of other criteria)

Last edited:

- Jul 10, 2003

- 26,036

Well then you've exhausted my somewhat limited knowledge of the state pension scheme then, because that was the only additional state pension I was aware of, but however it's arrived at it's good news (particularly of you don't have any private pensions in addition)I wasn’t born before 1951 or took my pension before 2016 so it’s just related to contributions paid that results in an additional “Protected payment” of approx £78/week on top of the new state pension of £185/week to give £263/week or £13.7k / year. This is going to increase by 10% to £15k in April.

- Aug 7, 2003

- 7,827

I had to go and look at the DWP calculation. I guess if you search for “Protected payment” online it will explain more. It’s to do with the calculation of the “Starting Amount” which is dependent on contributions made. On the Government Gateway website they list NI payments made. Mine amounted to circa £100k over 45 years.Well then you've exhausted my somewhat limited knowledge of the state pension scheme then, because that was the only additional state pension I was aware of, but however it's arrived at it's good news (particularly of you don't have any private pensions in addition)

A good thing about being an expat is that I only pay 12.60 a quarter and get full NI contributions. From conversations it seems many fellow expats are not aware of this either….me included until someone told me a few years ago.

- Aug 7, 2003

- 7,827

You’ll get a 10.1% increase on that in April taking it to £215.62This is my pension forecast and like you I was contracted out for a while.

Does this forecast include the Triple Lock rise for this year can anyone tell me please.

Bob!

Coffee Buyer

- Jul 5, 2003

- 11,165

Same here!! I’m 74p a week short of full amount! I’m not working and have no plans to work a year just to get my hands on the additional 74p/wk!!

View attachment 156518

You don't need to work a whole year.

You just need to qualify for NI contributions for one week (if weekly paid) or one month (if monthly) in any year, including the year to March 2023, or in the next 5 years.

Thunder Bolt

Silly old bat

Much too late. I was born before 1951.Too late for you to do this?

https://www.gov.uk/voluntary-national-insurance-contributions/deadlines

banjo

GOSBTS

The same for me. Full NIC years completed? Maybe they haven’t added the increase to mine yet.Oddly, having paid NIC in full all my life mine is saying I get the maximum, which is £185.15 per week, yours is a tenner more?