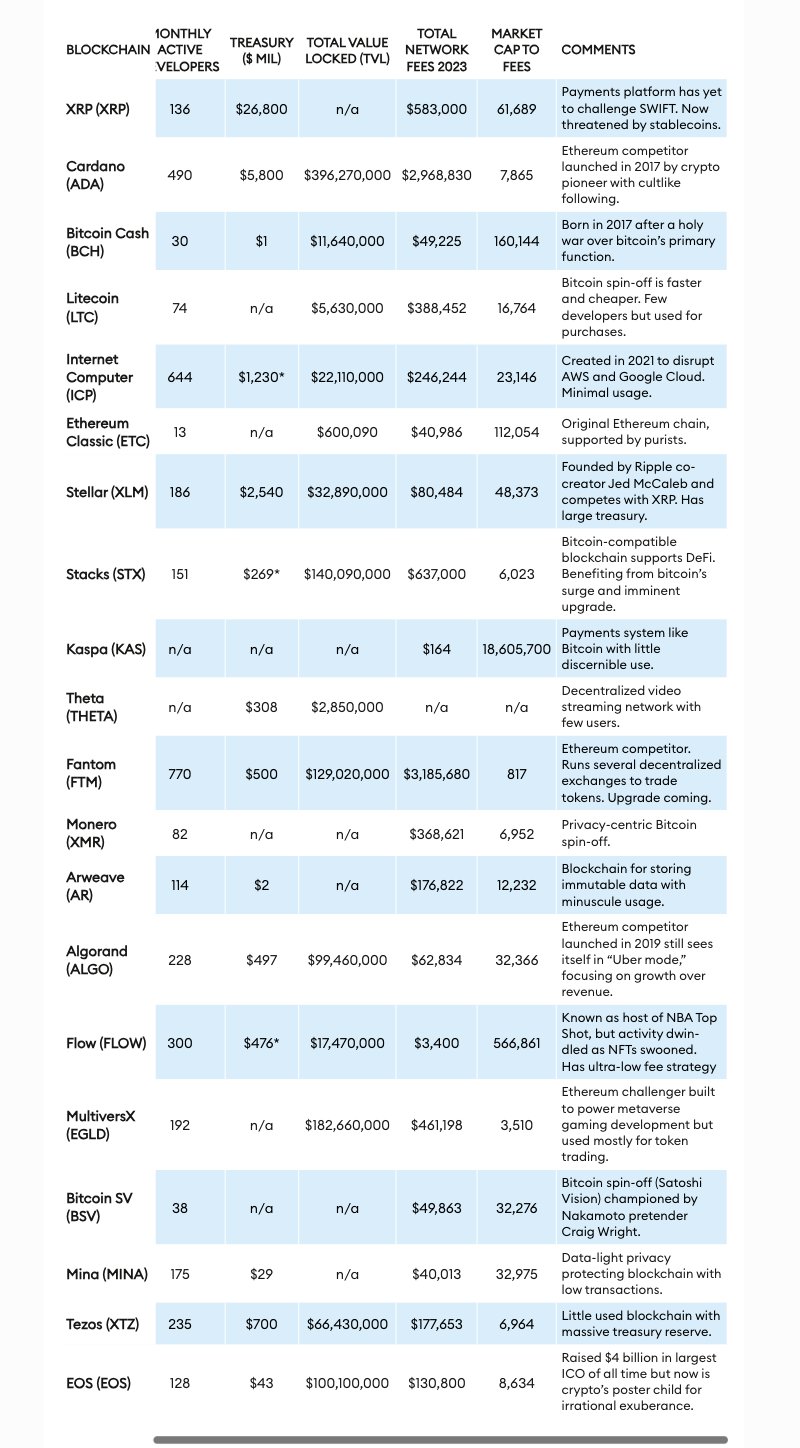

This has to be one of the best cryptocurrency put downs I have seen. The missing table is included in an image below.

https://www.forbes.com/sites/stevenehrlich/2024/03/27/the-rise-of-cryptos-billion-dollar-zombies/

https://www.forbes.com/sites/stevenehrlich/2024/03/27/the-rise-of-cryptos-billion-dollar-zombies/