You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

More options

Who Replied?Freddie Goodwin.

Well-known member

Just paid my tax 30 mins ago, shaking.

Hate paying tax when so many get away with it and are far richer than me and as a small business trying to turn a profit they expect me to pay tax on money I haven't made yet.

It makes my piss boil.

The 'payments on account' are based on the tax you paid for the previous year. If you know that you have not done that well in this current year (ending in April) then do your return early and those payment on accounts will be adjusted - you only pay tax on profits. You don't have to wait until next January.

Freddie Goodwin.

Well-known member

Apologies if i misunderstand your post, but in my experience not many people pay tax unless you are asked for it and then they take it up to the deadline.

In an ideal world we would put away 25% of your monthly takings and stuff it under the mattress, but due to things like cashflow, unexpected bills, making up for poor months to pay essential bills like mortgage, food etc it is tricky to stick to doing this every month.

I have enough put aside this time, but i know many who wait up to the deadline and just dont have it to pay and have to go cap in hand to anyone who will lend it to them or borrow from a bank or worse.

Even though i have it this time, i pay very reluctantly due to the unfairness of all the others that owe millions and get away with it, pay late and i get fined £100.

You don't get a fine for paying late, but you will be charged interest. The fine is for doing the return late. Some people get the fine and don't even have tax to pay, which is poor on them. You can get time to pay, if reasonable, and often it's best to set up a Direct Debit & pay throughout the year.

Rowdey

Well-known member

Pretty shit.. Christopher Lunn anyone ?

Shropshire Seagull

Well-known member

Shropshire Seagull

Well-known member

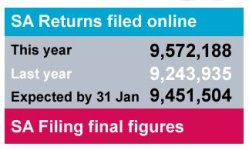

Bit more posted on the intranet today:

SA returns - 2017 in numbers

* 11.6 million SA returns due

* 10.76 million returns received by midnight on 31 January (92% of total issued)

* 9.57 million returns filed online (89%)

* 1.19 million returns filed on paper (11%)

* 769,000 returns received on 31 January alone

* More than 74,000 SA customer webchats in January and more than 24,000 webchats on the Online Services Helpdesk

* On 31 January alone, advisers answered more than 114,000 calls on the Taxes Helpline, 18,000 on the Online Services Helpdesk and 10,000 on the Debit Card Payment line.

SA returns - 2017 in numbers

* 11.6 million SA returns due

* 10.76 million returns received by midnight on 31 January (92% of total issued)

* 9.57 million returns filed online (89%)

* 1.19 million returns filed on paper (11%)

* 769,000 returns received on 31 January alone

* More than 74,000 SA customer webchats in January and more than 24,000 webchats on the Online Services Helpdesk

* On 31 January alone, advisers answered more than 114,000 calls on the Taxes Helpline, 18,000 on the Online Services Helpdesk and 10,000 on the Debit Card Payment line.

1.19m still filed on paper?! I haven't filed a paper return for any of my clients for years.

Unless it includes those for offshore companies etc which HMRC still require a bloody paper form from (why?). But I doubt they're included in the figures.

Unless it includes those for offshore companies etc which HMRC still require a bloody paper form from (why?). But I doubt they're included in the figures.